Allied Blenders and Distillers Limited, a player in the Indian alcoholic beverage industry, which recently concluded its Initial Public Offering (IPO). Known for its flagship brand, Officer’s Choice, the company has a significant presence in the Indian market and aims to use the funds raised through the IPO for various strategic initiatives.

The IPO opened for subscription from June 25, 2024, to June 27, 2024, and saw a robust response from investors across different categories. The total issue size was ₹1,500 crore, with both fresh issues and offers for sale contributing to the overall offering. The price band was set between ₹267 to ₹281 per share, with a minimum lot size of 53 shares.

On June 28, 2024, the basis of allotment for the Allied Blenders and Distillers IPO was finalized, providing clarity to investors about their allotment status. This article all about the IPO details, including the allotment process, financial performance, and key metrics that highlight the company’s market standing. It also covers the listing day trading information and other relevant details to comprehensively understand the IPO’s outcome.

Also Read:

- Stock Market Today: Nifty Set for Bullish Start Amid Global Optimism, FII Inflows, and Macro Tailwinds

- SBFC Finance Outlook: Investec Sees 27% Upside on Strong MSME Franchise

- Trump May Delay Tariff Hike Deadline: What It Means for Global Markets and the U.S. Economy

- Market Rally Outlook: All Eyes on Fed, Earnings Season, and FII Flows

- Precious Metal Shake-Up: Jewellery Stocks to Watch as Platinum Soars

IPO Details

- IPO Open Date: June 25, 2024

- IPO Close Date: June 27, 2024

- Allotment Finalization: June 28, 2024

- Listing Date: July 2, 2024

- Price Band: ₹267 to ₹281 per share

- Face Value: ₹2 per share

- Minimum Lot Size: 53 Shares

- Total Issue Size: 53,380,783 shares (₹1,500 Cr)

- Fresh Issue: 35,587,189 shares (₹1,000 Cr)

- Offer for Sale: 17,793,594 shares (₹500 Cr)

- Employee Discount: ₹26 per share

- Listing: BSE, NSE

Basis of Allotment

Share Reservation

| Investor Category | Shares Offered | Percentage |

|---|---|---|

| QIB | 10,654,804 | 20.00% |

| NII (HNI) | 7,991,103 | 15.00% |

| bNII (bids above ₹10L) | 5,327,402 | 10.00% |

| sNII (bids below ₹10L) | 2,663,701 | 5.00% |

| Retail | 18,645,907 | 35.00% |

| Employee | 117,647 | 0.22% |

| Anchor Investors | 15,982,206 | 30.00% |

| Total | 53,274,020 | 100% |

Application and Allotment Details

| Category | Minimum Lots | Shares | Amount (₹) |

|---|---|---|---|

| Retail (Min) | 1 | 53 | 14,893 |

| Retail (Max) | 13 | 689 | 193,609 |

| sNII (Min) | 14 | 742 | 208,502 |

| sNII (Max) | 67 | 3,551 | 997,831 |

| bNII (Min) | 68 | 3,604 | 1,012,724 |

Also Read:

- Petro Carbon and Chemicals IPO Basis of Allotment: July 2024

- Divine Power IPO Basis of Allotment(Updated)

- Ganesh Green Bharat Limited IPO: Updated Details

- Tata Technologies IPO: Comprehensive Overview

- ideaForge Technology Limited IPO Review

Promoter Holding

| Details | Pre-Issue (%) | Post-Issue (%) |

|---|---|---|

| Promoter Holding | 96.21% | 80.91% |

Financial Performance (Restated Consolidated)

| Period Ended | Total Assets (₹ Cr) | Total Revenue (₹ Cr) | Profit After Tax (₹ Cr) | Net Worth (₹ Cr) | Reserves and Surplus (₹ Cr) | Total Borrowing (₹ Cr) |

|---|---|---|---|---|---|---|

| 31-Dec-2023 | 2,741.39 | 5,914.98 | 4.23 | 409.26 | 360.43 | 798.11 |

| 31-Mar-2023 | 2,487.70 | 7,116.75 | 1.60 | 406.10 | 357.28 | 780.82 |

| 31-Mar-2022 | 2,248.35 | 7,208.17 | 1.48 | 404.10 | 356.99 | 846.91 |

| 31-Mar-2021 | 2,298.57 | 6,397.81 | 2.51 | 381.78 | 327.85 | 954.74 |

Key Performance Indicators

| KPI | Value |

|---|---|

| ROE | 1.03% |

| ROCE | 24.35% |

| Debt/Equity | 1.88 |

| RoNW | 1.03% |

| P/BV | 16.77 |

| PAT Margin (%) | 0.17 |

| Market Cap | ₹7859.59 Cr |

Listing Day Trading Information

| Exchange | Final Issue Price (₹) | Open (₹) | Low (₹) | High (₹) | Last Trade (₹) |

|---|---|---|---|---|---|

| BSE | 672.00 | 1,305.10 | 1,257.80 | 1,344.00 | 1,295.50 |

| NSE | 672.00 | 1,300.00 | 1,260.00 | 1,343.95 | 1,294.95 |

Yes, we can create charts to help you better understand financial performance, subscription status, and day trading information.

Financial Performance Over the Years

Financial Performance (Restated Consolidated) – Total Assets and Total Revenue

| Period Ended | Total Assets (₹ Cr) | Total Revenue (₹ Cr) |

|---|---|---|

| 31-Mar-20 | 79.79 | 16.32 |

| 31-Mar-21 | 123.74 | 36.34 |

| 31-Mar-22 | 222.33 | 161.45 |

| 31-Mar-23 | 487.93 | 196.40 |

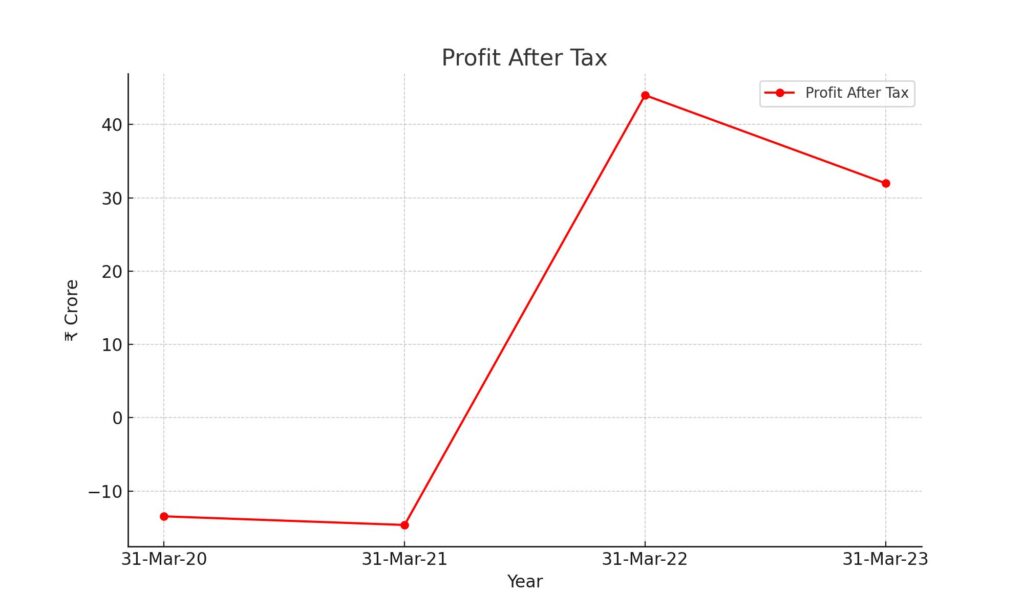

Financial Performance (Restated Consolidated) – Profit After Tax

| Period Ended | Profit After Tax (₹ Cr) |

|---|---|

| 31-Mar-20 | -13.45 |

| 31-Mar-21 | -14.63 |

| 31-Mar-22 | 44.01 |

| 31-Mar-23 | 31.99 |

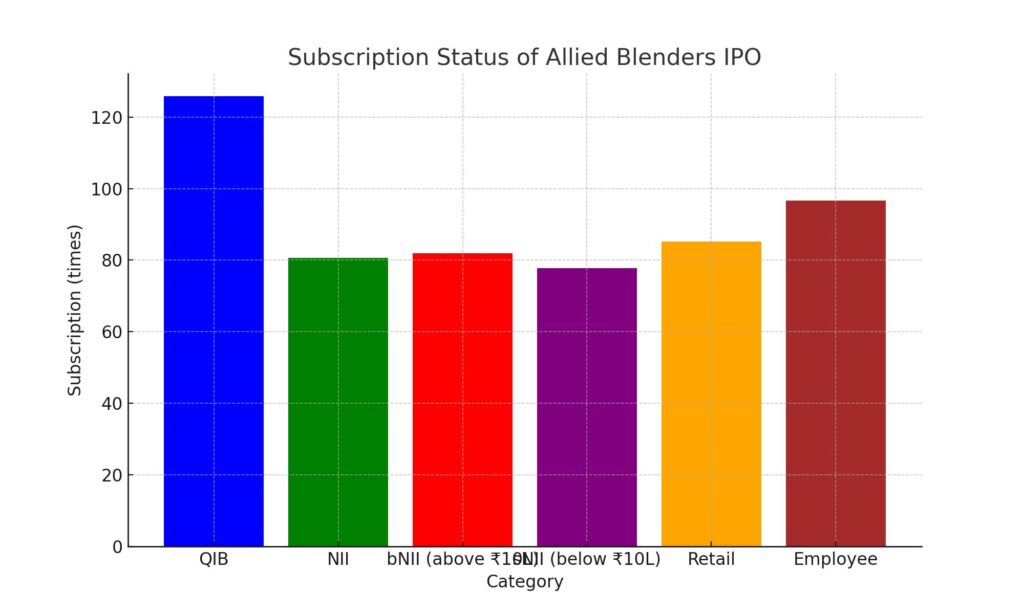

Subscription Status

Subscription Status as of June 30, 2023

| Category | Subscription (times) |

|---|---|

| QIB | 125.81 |

| NII | 80.58 |

| bNII (bids above ₹10L) | 81.99 |

| sNII (bids below ₹10L) | 77.77 |

| Retail | 85.20 |

| Employee | 96.65 |

| Total | 106.06 |

| Total Applications | 2,509,004 (65.49 times) |

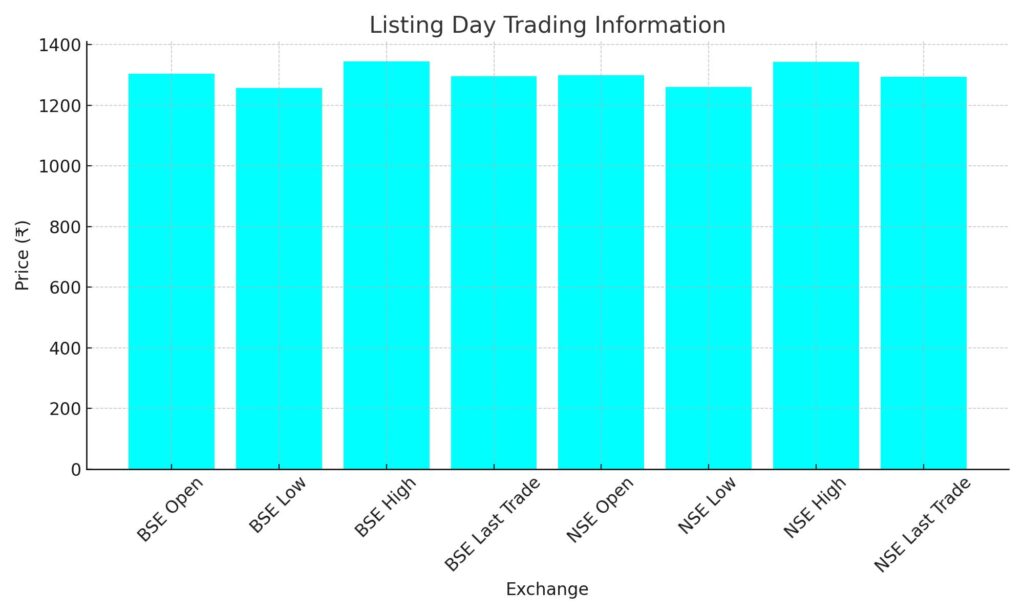

Listing Day Trading Information

| Exchange | Final Issue Price (₹) | Open (₹) | Low (₹) | High (₹) | Last Trade (₹) |

|---|---|---|---|---|---|

| BSE | 672.00 | 1,305.10 | 1,257.80 | 1,344.00 | 1,295.50 |

| NSE | 672.00 | 1,300.00 | 1,260.00 | 1,343.95 | 1,294.95 |

Contact Information

Allied Blenders and Distillers Limited

- Address: 394-C Lamington Chambers, Lamington Road, Mumbai – 400 004, Maharashtra, India

- Phone: +91 22 43001111

- Email: complianceofficer@abdindia.com

- Website: abdindia.com

Registrar: Link Intime India Private Ltd

- Phone: +91-22-4918 6270

- Email: abdl.ipo@linkintime.co.in

- Website: Link Intime

People May Ask

When is the Allied Blenders IPO allotment expected?

The allotment status is available as of June 28, 2024.

How to check Allied Blenders IPO allotment status?

Visit the Link Intime allotment status page, select the company name, and enter your PAN Number, Application Number, or DP Client ID.

What is the listing date for Allied Blenders IPO?

The shares are listed on BSE and NSE on July 2, 2024.

What is the minimum investment required for Allied Blenders IPO?

The minimum investment for retail investors is ₹14,893 for one lot of 53 shares.