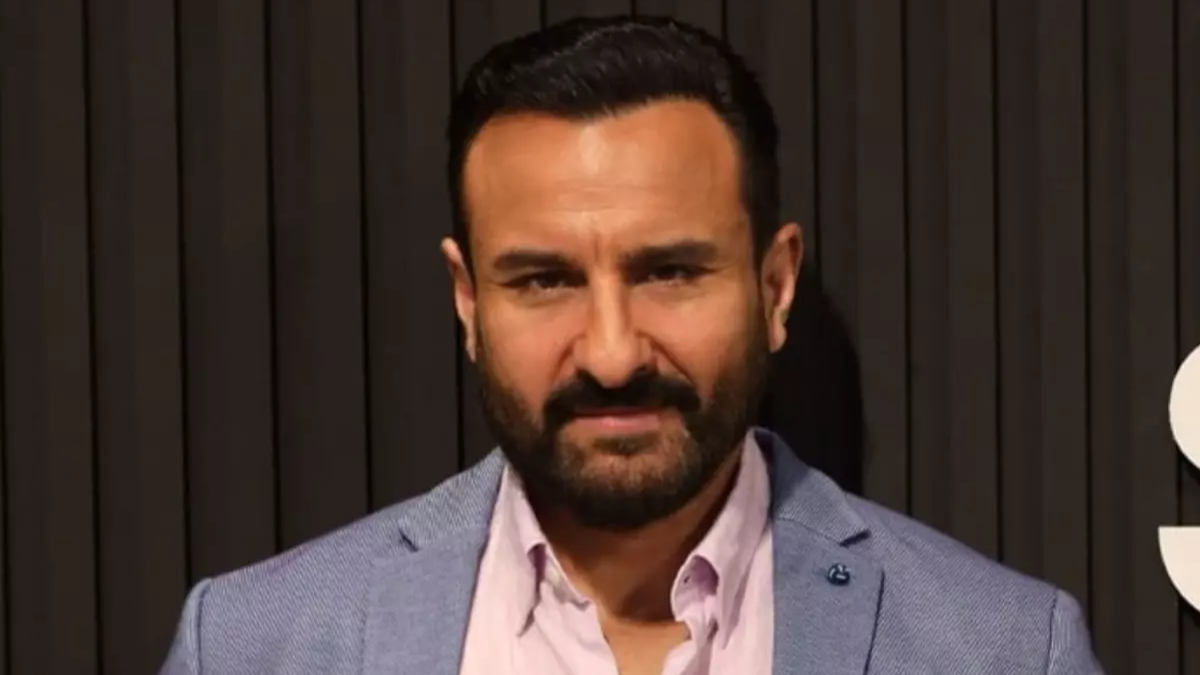

The recent health insurance claim filed by Bollywood actor Saif Ali Khan has reignited discussions about disparities in how health insurers handle claims for high-profile individuals versus the average person. Following an attack that left Khan with stab wounds, he was hospitalized at Lilavati Hospital and filed a claim for ₹35.95 lakh. While the insurer, Niva Bupa, initially approved ₹25 lakh for cashless treatment, the full claim settlement sparked a debate on preferential treatment for celebrities.

Social media erupted with claims that ordinary individuals face significant hurdles in getting their claims approved, unlike celebrities who reportedly receive prompt settlements to avoid negative publicity. Insurance expert and finfluencer Nikhil Jha summarized the sentiment by stating, “Every common man is a star and deserves to get a high rightful claim.”

How Does the Health Insurance Process Differ for Celebrities and Common People?

- Quick Approvals for Celebrities:

- High-profile claims, like that of Saif Ali Khan, are often approved within minutes, reportedly to prevent negative PR.

- Common individuals, however, may face delays caused by thorough investigations, repeated queries, and scrutiny of medical documents.

- Challenges for Common People:

- Insurers apply “Reasonable and Customary Charges”, often reducing the approved amount.

- Senior citizens, in particular, face high premiums despite their limited income, as highlighted by Dr. Prashant Mishra, a cardiac surgeon in Maharashtra.

- Social Media Backlash:

Many have voiced concerns that health insurers prioritize celebrities over the general public. This disparity undermines trust in the system and calls for stricter oversight by the Insurance Regulatory and Development Authority of India (IRDAI).

What Are the Updated IRDAI Guidelines for Health Insurance?

To address systemic challenges, the IRDAI implemented key reforms in May 2024 aimed at streamlining the claims process for all policyholders:

- Faster Claims Approval:

- Insurers must provide final authorization within three hours of receiving a discharge request from the hospital.

- If the claim is delayed beyond this timeframe, additional costs incurred by the hospital will be covered by the insurer.

- Immediate Settlements in Critical Cases:

- In cases where the policyholder passes away during treatment, the claim must be processed immediately, and the hospital must release the mortal remains without delay.

- Digital Pre-Authorization:

- Insurers are required to adopt digital pre-authorization systems, approving treatment costs upfront to reduce last-minute financial stress on patients and families.

- Transparency in Claim Denials:

- Claims cannot be denied without the approval of a Primary Medical Consultant (PMC) or a three-member Claims Review Committee (CRC).

- If a claim is denied or partially approved, insurers must provide detailed explanations referencing the policy’s terms and conditions.

Are Insurers Catering to All Needs?

The IRDAI has emphasized the importance of diverse insurance products catering to all age groups, medical conditions, and budgets. Policyholders now have the flexibility to:

- Choose the insurer under which they wish to file claims.

- Coordinate claims across multiple policies, ensuring coverage for any additional amounts.

This inclusive approach aims to create a fairer health insurance landscape, addressing concerns about disparities between celebrity and common policyholders.

FAQs

Why is Saif Ali Khan’s insurance claim controversial?

His quick claim approval of ₹35.95 lakh sparked debates about whether celebrities receive preferential treatment compared to ordinary policyholders.

What are “Reasonable and Customary Charges”?

These are limits applied by insurers to ensure claims align with standard treatment costs, often reducing the approved amount for common policyholders.

How do the new IRDAI guidelines improve claims processing?

The updated rules mandate faster approvals, transparency in claim denials, and immediate settlements in critical cases.

Are senior citizens unfairly treated by insurers?

Yes, many senior citizens face high premiums despite their limited income. Experts have called for more affordable and consistent policies for retired individuals.

What is digital pre-authorization in health insurance?

It is a process where insurers approve a fixed amount for treatment upfront, ensuring patients face minimal delays during emergencies.

Can policyholders choose which insurance policy to use for claims?

Yes, IRDAI allows policyholders to select the policy under which they want to file claims, even if they hold multiple policies.

Why do celebrities get quicker approvals?

To avoid negative publicity, insurers often prioritize claims for high-profile individuals, whereas ordinary claims undergo detailed scrutiny.

What should common policyholders do to ensure claim approval?

Policyholders should familiarize themselves with their insurance policy’s terms, maintain accurate documentation, and follow up persistently with insurers.

Click here to know more.